Phoenix Housing Market Slowing

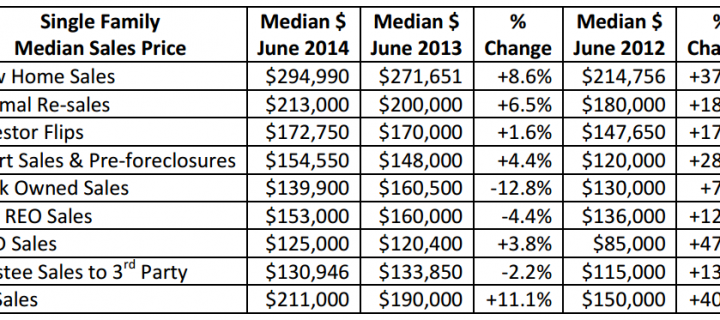

The Phoenix housing market remains sluggish, with single-family home sales down 11 percent from June 2013 according to a new report issued by the W.P. Carey School of Business at Arizona State University. The home sales may have been down but the pricing was up with an average price per sq. ft. gaining nearly 10% from June 2013 from $117.08 to $128.69. An amazing statistic when comparing available properties from June 2014 to June 2013 is the amount of listings. There are 59% more active listings than July 1, 2013! Foreclosure starts are down 38% from June 2013. The investment activity for residential property from Investors was reduced from 16.1% in May to 14.4% in June. The number of rental homes offered for Lease on ARMLS (excluding vacation rentals) was 4,204 as of July 1, 2014. This is up 5% from a month earlier. However this still represents just 1.2 months of supply. According to the study rental rates are also rising. “We are currently seeing a 6% rise over the last 12 months across the Greater Phoenix Area.” says the report. Phoenix property management company Property Butler will provide a free Rental Analysis. The free Rental Analysis will provide you with comparable recently rented properties in your area to ensure you are getting a market rental rate. Household formation statistics improved in the second quarter of 2014 according to the U.S. Census Bureau. “The first beneficiaries from improving housing creating numbers are usually landlords, and vacancies continue to remain low.” “The supply of available homes for purchase at the bottom end of the market (under $175,000) is very tight. Most attractive homes below this price are being snapped up quickly despite the lack of investor buyers. Above $175,000 we still have more supply than necessary to meet the weak demand,” according to the report. The report is issued by Michael J. Orr the Director for the Center for Real Estate Theory and Practice at...

Read More (602) 859-7991

(602) 859-7991